Mick Wilson, Cashflow Planner Product Manager at Zooss Consulting, explains how a new solution provides better cashflow management for businesses – and peace of mind for finance managers.

Cashflow Planning: The number one priority for finance departments

For most finance teams, the top priority is ensuring business continuity by managing cashflow effectively. A reliable and dynamic cashflow forecast is essential for financial sustainability, yet it involves more than a simple P&L forecast.

Does your closing cash equal your bank balance on the balance sheet? Does your forecasted balance sheet actually balance? Can you easily manage your cash and your bank covenant in one solution? Do you have a reliable, scalable cashflow management tool? If not, confidence in your cashflow planning dwindles.

To add to the challenge, manufacturing and seasonal businesses often experience large, and misaligned cash inflows and outflows throughout the year, making cashflow planning especially demanding.

Bringing clarity and confidence to cashflow planning, for enhanced decision-making

At Zooss Consulting, we’ve developed a quick-to-implement app that seamlessly integrates your P&L, balance sheet, and cashflow statement.

Cashflow Planner empowers finance managers to generate balance sheets and cashflow plans with ease, while stress-testing various financial scenarios. With detailed insights available at monthly, weekly or daily grain for five years into the future, obstacles to cashflow can be identified and circumvented before they become problematic.

Utilising the more meaningful direct cashflow method, this reliable and powerful tool delivers trustworthy insights that enhance decision-making and ensure financial sustainability.

Cashflow Planner revolutionises financial management by allowing modelling of multiple scenarios and options, with automatic double entries across P&L and balance sheets keeping data consistently in sync.

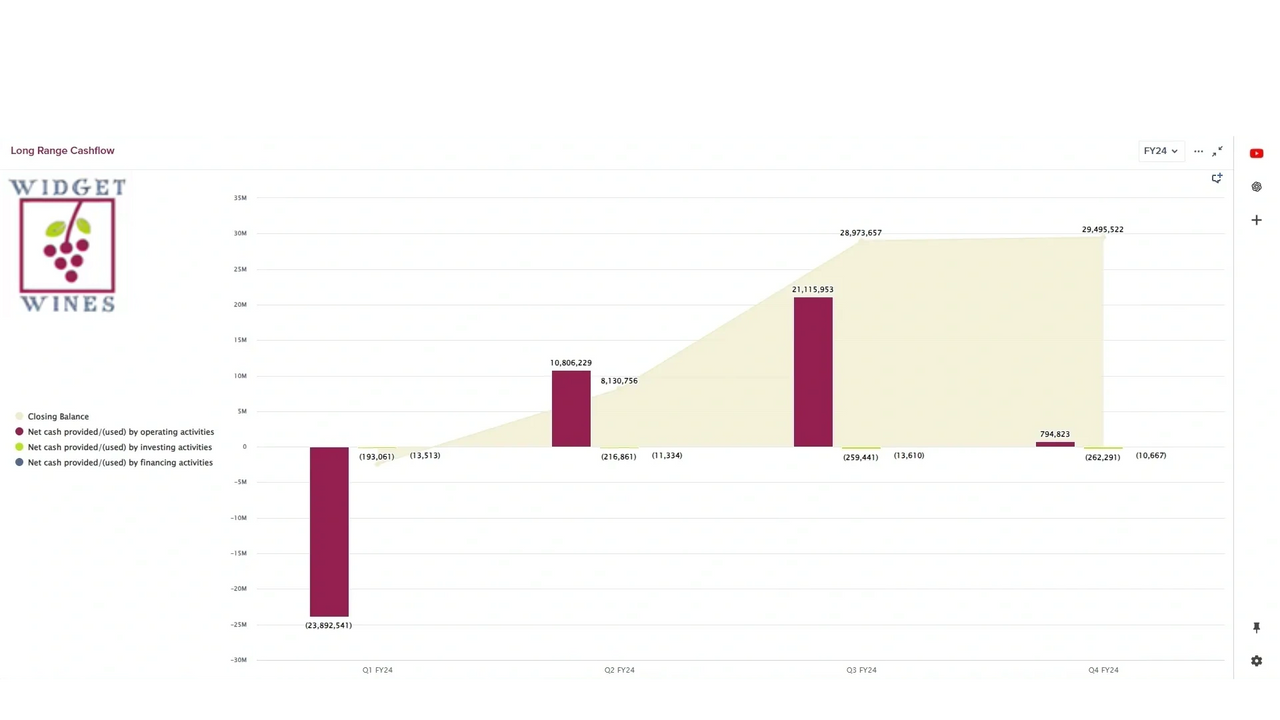

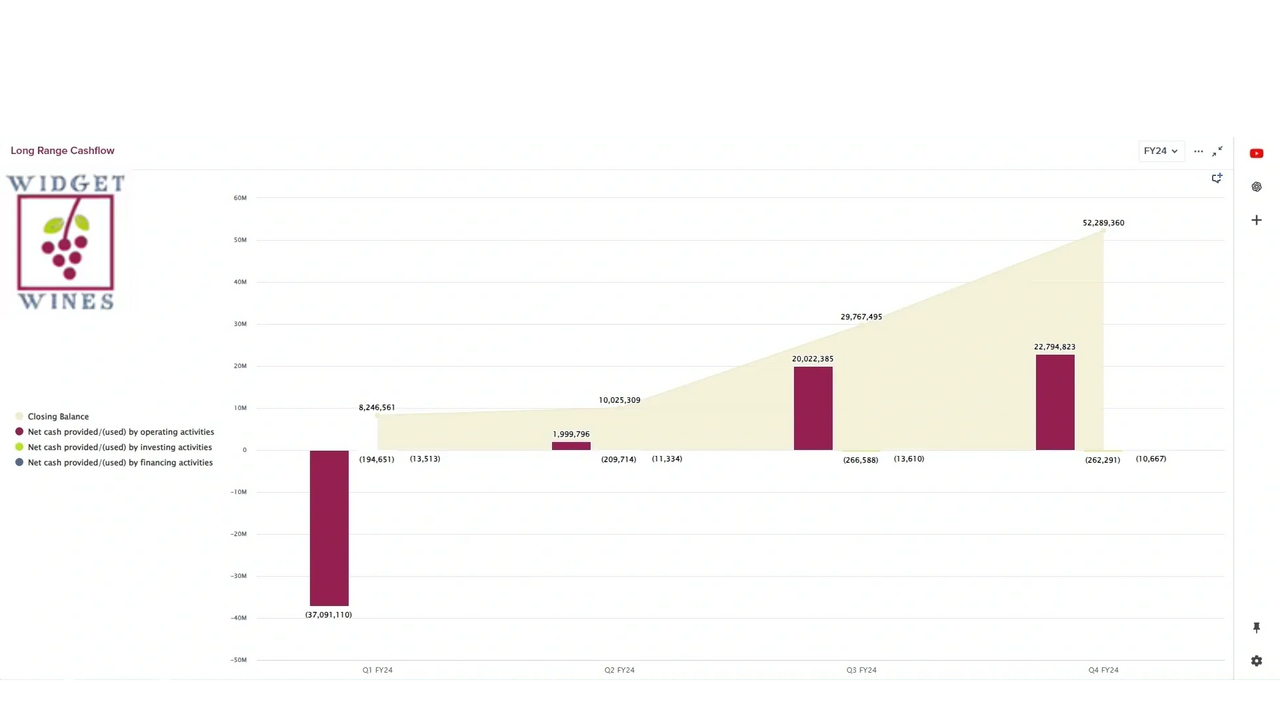

Let’s take a look at a cashflow planning example…

The cashflow challenge for seasonal businesses

Welcome to the world of Widget Wines

Like many manufacturers and agribusinesses, Widget Wines faces significant seasonal fluctuations in operating cashflows. The bulk of their cash outflows occur during Q1 – including payments covering harvesting grapes, wine production, bottling, labelling, and transportation.

However, cash inflows from wine sales remain relatively stable across the year, creating a cashflow imbalance that necessitates additional financing.

Widget Wines’ current spreadsheet-heavy cash management processes are inefficient and time-consuming. The finance manager is under pressure from the CFO to deliver reliable and timely financial information to drive strategic actions.

Our solution for confident cashflow management

By implementing the Cashflow Planner, Widget Wines’ finance manager leverages daily granularity and custom financial levers to accurately forecast operating cashflows, including customer receipts and supplier payments. This enhanced accuracy and detail enables better management of working capital and reduction of safety buffers, such as in inventory.

Cashflow Planner modelling optimises operating cashflows

The finance manager effortlessly models various financing combinations, optimising total cashflow and minimising borrowing costs. Replacing legacy spreadsheets with the robust, integrated Cashflow Planner allows for more insightful, timely, and reliable analyses. Consequently, the CFO receives the necessary information for decision-making without the finance manager enduring late nights.

A versatile and robust cashflow planning tool specifically designed for manufacturing and agribusiness

Cashflow Planner is a pre-built model for balance sheet and cashflow planning. Built on the Anaplan Connected Planning platform, and tailored by Zooss’ expert team with the manufacturing and agribusiness sectors in mind, it caters to the unique requirements of businesses with large seasonal variations in cash inflows and outflows, and those making or reselling physical products.

For many organisations, financial planning is the beginning of their Connected Planning journey, before moving on to processes like supply chain and workforce planning. At Zooss, we’re pioneering a new approach to business planning, which we call Sustainable Business Planning (SBP). Sustainable businesses recognise the equal importance of financial, environmental, and social outcomes, and hence a sustainable business plan must include modelling of all three.

Find out more about cashflow planning:

To discover how Cashflow Planner can bring clarity and confidence to your cashflow planning, contact:

Mick Wilson, Cashflow Planner Product Manager, Zooss Consulting, mick.wilson@zooss.com.au

Mick is an experienced solution delivery lead with a strong history of delivering successful digital transformation and software implementation projects for large, complex organisations in various industries. He is passionate about empowering organisations and teams to thrive through tech-supported process improvements and driving towards a sustainable future.

To discuss your social sustainability reporting and planning requirements, contact us.

Better Planning. Better Planet.