Sustainability reporting – a closer look

Aside from the fact that in some cases it’s mandatory, it’s important to recognise that it’s not reporting for reporting’s sake; or at least it shouldn’t be.

In the first few series of this Blog, we looked at the “what” of sustainability reporting; that is, the kind of reporting that is becoming expected and the frameworks and guidelines being developed to facilitate it. Let’s look more closely now at the “why” of reporting.

The reasons to report stem from the recognition that:

a) the state of the world has an impact on business performance and

b) the performance of a business has an impact on the state of the world.

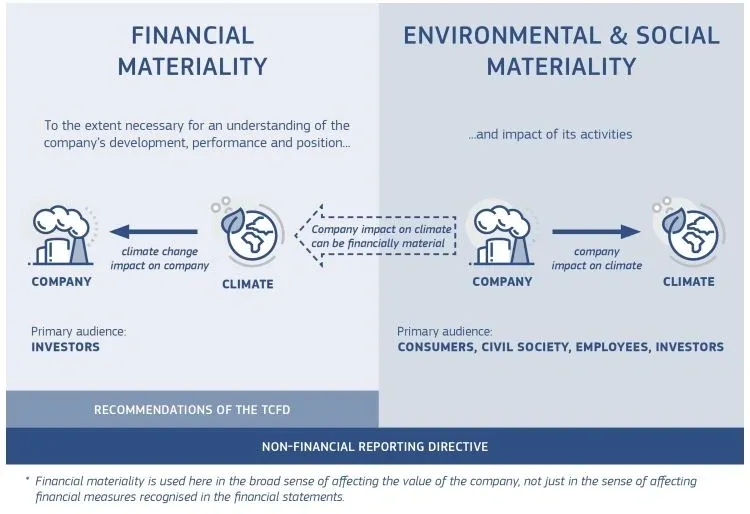

This is known as ‘double materiality’. In the first instance, current and potential investors and lending agencies are interested in the financial risk profile and growth potential of a company, as relates to Environmental Social Governance (ESG) matters. This is known as financial materiality. In the second instance, other stakeholders like staff and the broader community are interested in the ways in which a company impacts ESG issues, so that it might be appraised, and any negative impacts reduced. This is known as impact materiality, or environmental and social materiality.

Sustainability data, reports and targets

The sustainability of a business therefore affects not just the obvious stakeholders, but the global community as a whole. Reporting wholistically on those impacts should be considered due diligence. As we will see, the data collected in these reports also has broad utility in achieving global sustainability targets. Furthermore, the process of writing the report itself generates various quantifiable benefits for companies.

In the next blog we’ll look at the opportunities to develop and demonstrate awareness, generated by conducting sustainability reporting.

Read more about Sustainable Business Planning.

To discuss your sustainability reporting and planning requirements, contact us.

Better Planning. Better Planet.