The global architecture of sustainability reporting is becoming more streamlined. Over the last 12- 18 months, multiple standards are being streamlined into fewer, and more internationally recognised frameworks, to help simplify and fortify the reporting efforts of organisations.

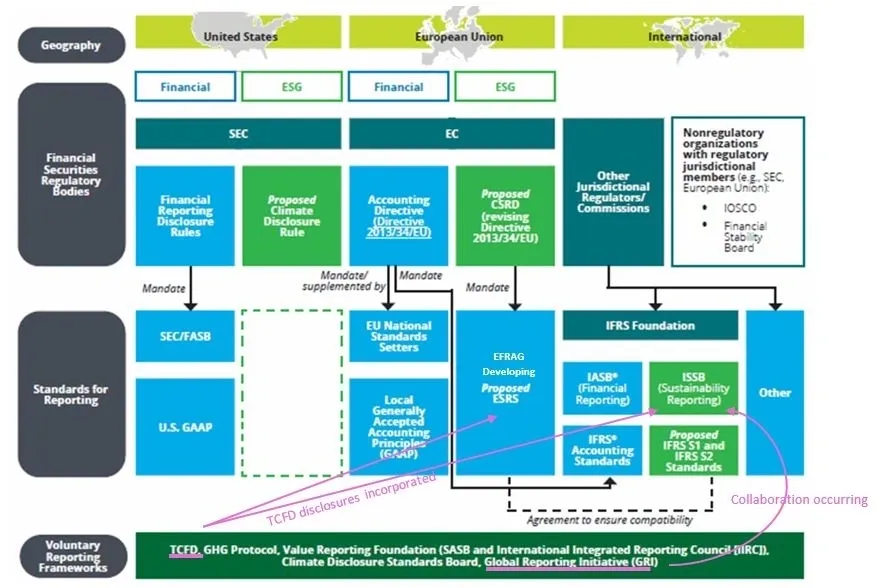

The world of sustainability reporting is/was notorious for its vast array of acronyms describing an equally vast array of frameworks and standards. The number of standards available has led to inconsistencies in what is being reported and has made the collection and dissemination of sustainably related disclosures a challenge for both those reporting, and those interpreting, the information. Recent efforts by various global reporting and standards agencies have therefore been aimed at ensuring the compatibility and consistency in sustainability reporting at an international level. Their goal is to reduce the compliance burden for reporting organisations, and to improve everyone’s overall understanding of what companies are actually doing to measure and mitigate their operational risks and impacts.

Reporting on sustainability-related risk

In March 2022, the International Financial Reporting Standards (IFRS) merged various bodies to establish the International Sustainability Standards Board (ISSB). It is tasked with developing a global baseline for disclosure standards that will guide reporting on sustainability-related risk by companies to investors and other financial market participants. Significantly, this board has agreed to collaborate closely with the Global Sustainability Standards Board (GSSB), overseen by the Global Reporting Initiative (GRI), in order to ensure coordination between the development of financial impact disclosures and non-financial impact disclosures. These international standards will serve to make the reporting landscape more consistent across jurisdictions. It also signals an increasingly entrenched commitment to the principle of double materiality, in which the impact of a company on the climate and ecosystem health is considered in addition to the impact of ecosystem health and the climate on the company.

Sustainability reporting frameworks

In parallel to the ISSB, the EU is also working to streamline their reporting frameworks, with the European Commission adopting the Corporate Sustainability Reporting Directive (CSRD) in April 2021, scheduled for implementation in 2023. This directive is a revision of the 2014 Non-Financial Reporting Directive (NFRD), which required companies to report on how they are impacted by, and impact upon, different sustainability metrics. Furthermore, it stipulates that they adopt the European Sustainability Reporting Standards (ESRS) (newly developed and released in April 2022 by the European Financial Reporting Advisory Group (EFRAG)), rather than using a framework of their own choosing.

Efforts to streamline global sustainability reporting architecture are indicative of the momentum that is building in the corporate ESG space, as climate disclosures become an established requisite for both the legal and social license to operate.

Embedding sustainability into business strategy

At Zooss, our planet-passionate team believes that embedding sustainability into business strategy, operations and culture is essential for organisations aiming to drive positive change in their business and sustainability impact.

Find out more about Sustainable Business Planning and to start planning sustainably, contact us.

Better Planning. Better Planet.